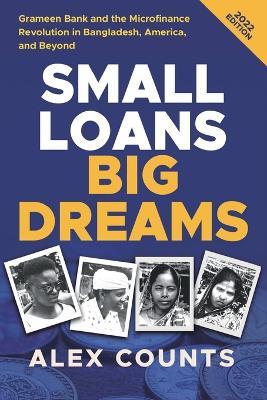

Microfinance-providing low-interest loans and other financial services to help the poorest people lift themselves out of poverty-was pioneered by the Grameen Bank in Bangladesh. In 2006, the bank and its founder, Muhammad Yunus, were jointly awarded the Nobel Peace Prize, and microfinance has since gone on to serve over 100 million people-mostly women-on five continents.

First published in 1996, Small Loans, Big Dreams is the classic account of the origins and development of microfinance, from the $27 in loans given by a young economics professor to liberate poor villagers from loan sharks to its present status as a sometimes-controversial global phenomenon. Alex Counts, a protegé of Yunus and founder of the Grameen Foundation, paints vivid portraits of the determined women he came to know whose lives have been transformed by the opportunity to launch a small business, first in the countryside of Bangladesh, then in downtown Chicago, where an experimental project brought the microfinance method to America.

In this new edition, Counts traces the history of microfinance, exploring the ways Grameen Bank has evolved in response to challenges from economic downturns to environmental crises. He depicts the various forms-some highly effective, others less so-that microfinance has taken in countries around the world, including Grameen America, the rapidly growing microfinance enterprise now headed by Andrea Jung that serves thousands of women across the U.S. Finally, Counts responds to critics who have questioned the value of the Grameen model and describes the lasting legacy of Yunus's remarkable vision. Small Loans, Big Dreams shows how microfinance can play a critical role in reducing the scourge of inequality by enabling underprivileged people to participate creatively in the global economy.