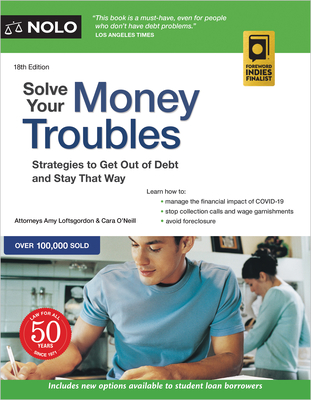

Solve Your Money Troubles: Strategies to Get Out of Debt and Stay That Way

Solve Your Money Troubles: Strategies to Get Out of Debt and Stay That Way

Are you overwhelmed by debt? Struggling to recover financially after losing your job or income due to the coronavirus crisis? If you're facing collection calls, a wage garnishment, foreclosure, car repossession, or a lawsuit, this book is for you. Solve Your Money Troubles is a comprehensive guide that provides the practical information you need to take financial control of your life. Learn how to: prioritize debts and create a budget stop harassment by debt collectors negotiate with creditors deal with wage garnishment, car repossession, and foreclosure reduce or eliminate student loan payments know what to expect if a creditor sues decide if bankruptcy is the right option for you, and rebuild your credit. The new edition of Solve Your Money Troubles is updated with the latest legal developments in the world of debt, credit, and bankruptcy. You'll also find sample letters you can use when negotiating with creditors, worksheets to help you create a plan to repay your debts, and other practical forms to help you get out of debt and make a fresh start.

Struggling with debt? Find solutions here. Conquering overwhelming debt starts with understanding your options. Solve Your Money Troubles gives you the tools you need to get your finances back on track. Learn how to: stop debt collector harassment cold negotiate down your debt with creditors reduce your student loan payments, and create a healthy financial plan that you can live with. But that's not all. Solve Your Money Troubles helps you handle the big issues, too. Find out how to: stop a wage garnishment from leaving you penniless get your car back after a repossession prevent a foreclosure by applying for a loss mitigation program respond to an action if you get sued, and decide if it's time to wipe the slate clean by filing for bankruptcy. In addition to up-to-date legal information, you'll find practical tools, such as sample creditor letters and budgeting worksheets. And, if the law changes, you won't be left out of the loop. You'll have online access to all of the latest debt, credit, and bankruptcy developments.

Struggling with debt? Find solutions here. Conquering overwhelming debt starts with understanding your options. Solve Your Money Troubles gives you the tools you need to get your finances back on track. Learn how to: stop debt collector harassment cold negotiate down your debt with creditors reduce your student loan payments, and create a healthy financial

PRP: 154.93 Lei

Acesta este Prețul Recomandat de Producător. Prețul de vânzare al produsului este afișat mai jos.

139.44Lei

139.44Lei

154.93 LeiIndisponibil

Descrierea produsului

Are you overwhelmed by debt? Struggling to recover financially after losing your job or income due to the coronavirus crisis? If you're facing collection calls, a wage garnishment, foreclosure, car repossession, or a lawsuit, this book is for you. Solve Your Money Troubles is a comprehensive guide that provides the practical information you need to take financial control of your life. Learn how to: prioritize debts and create a budget stop harassment by debt collectors negotiate with creditors deal with wage garnishment, car repossession, and foreclosure reduce or eliminate student loan payments know what to expect if a creditor sues decide if bankruptcy is the right option for you, and rebuild your credit. The new edition of Solve Your Money Troubles is updated with the latest legal developments in the world of debt, credit, and bankruptcy. You'll also find sample letters you can use when negotiating with creditors, worksheets to help you create a plan to repay your debts, and other practical forms to help you get out of debt and make a fresh start.

Struggling with debt? Find solutions here. Conquering overwhelming debt starts with understanding your options. Solve Your Money Troubles gives you the tools you need to get your finances back on track. Learn how to: stop debt collector harassment cold negotiate down your debt with creditors reduce your student loan payments, and create a healthy financial plan that you can live with. But that's not all. Solve Your Money Troubles helps you handle the big issues, too. Find out how to: stop a wage garnishment from leaving you penniless get your car back after a repossession prevent a foreclosure by applying for a loss mitigation program respond to an action if you get sued, and decide if it's time to wipe the slate clean by filing for bankruptcy. In addition to up-to-date legal information, you'll find practical tools, such as sample creditor letters and budgeting worksheets. And, if the law changes, you won't be left out of the loop. You'll have online access to all of the latest debt, credit, and bankruptcy developments.

Struggling with debt? Find solutions here. Conquering overwhelming debt starts with understanding your options. Solve Your Money Troubles gives you the tools you need to get your finances back on track. Learn how to: stop debt collector harassment cold negotiate down your debt with creditors reduce your student loan payments, and create a healthy financial

Detaliile produsului